© Copyright Fowlkes McPherson Insurance. All Rights Reserved. Website Design and Hosting by North Mobile Internet Services, Inc.

Fowlkes McPherson Insurance

Commercial Property and Casualty Insurance

Medical Malpractice Insurance

Alabama Medical Malpractice Insurance: What you need to know. The medical malpractice insurance market in Alabama has some of the nation's lowest insurance premiums. The Alabama market has also significantly stabilized mostly due to the relatively calm legal climate in the state. The market was once dominated by a single insurance company; however, the market has significantly expanded in recent years through the efforts of agencies like ours. Some of the policy features one can expect on their Alabama medical malpractice insurance policy are: • Defense costs outside of the limits • Full consent to settle • Business entity coverage • Licensing action defense • Regulatory proceeding insurance • Cyber liability insurance Statute of Limitations In Alabama, medical malpractice claims must be brought within 2 years of the date of injury. If the injury was not discovered immediately, then a plaintiff has 6 months from the discovery date or the date that the injury should reasonably have been discovered. After 4 years from the date of the negligent act that gave rise to the injury, no action can be filed regardless of the date of discovery. If the case involves a minor, actions must be brought within 4 years of the negligent act. If the minor is less than 4 years of age, a case may be filed at any time before the child’s 8th birthdayUnderwriting

The fierce competition amongst medical malpractice carriers within the current "soft market" has pushed the underwriting process well beyond the realm of manual rates and formulaic quotations. We are seeing base rates slashed by up to 70% for applicable risks. How does a small to midsize practice access the maximum credits that can be realized in this environment? You need an agency skilled in the fluid terrain of this environment -- that can define and advocate each and every available credit while establishing competitive leverage most effectively in your favor. You need an agency who maintains positive relationships with their underwriters and has the ear of company executives whenever necessary. You need an agency who drafts clean submissions with clear narratives, who can convey where the leading edge of a winning target lies. You need an agency who can bring that target to the inked offer through relentless attentiveness throughout the entire submission process. There is much gamesmanship in the current market culture, and we love nothing more than winning big on your behalf.Renewals

Approximately 90 - 120 days prior to your program’s renewal, we will contact you for an annual review and evaluation. We will gather updated information as needed or requested by the incumbent market. We will discuss any recent changes that may have occurred in your practice, and collectively discuss our strategy in achieving the most optimum renewal results.Risk Management

For years MedPro Group has been the expert on risk management and patient safety issues. Our strong tradition of risk management continues today with comprehensive resources and solutions that are designed to help insureds improve patient safety and reduce liability exposures. MedPro Group insureds have access to a wealth of risk- related information and expertise, including core risk and specialty-specific publications, tools, and educational offerings, as well as a seasoned team of consultants who average more than 25 years in the industry. Additionally, MedPro Group is pleased to offer a variety of general and targeted risk management continuing education courses through our webinar program and preferred vendors. Insureds who successfully complete risk education might be eligible for a risk management premium credit at their next policy renewal. We believe that a strong risk management program is capable of reducing harm toward patients and protecting healthcare providers from liability. Through our services, we strive to increase awareness of enduring and emerging risks, improve patient safety, assist in prioritizing key issues for action, and work with insureds to demonstrate measurable improvement.Defense Attorney Panel

There is no stronger protection available in Alabama than our team of experts. In addition to providing you with winning defense, we arm you with: • Unparalleled national trial win history • 110-year track record of financial strength and stability • Commitment to Alabama physicians • True consent-to-settle provision with no strings attached • Access to more than 7,500 expert witnesses • Seasoned claims managers who average more than 20 years’ experience • A choice between occurrence and claims-made coveragePremium Indication Request

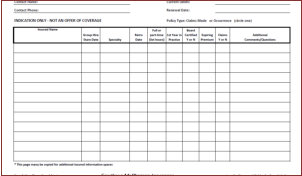

Obtaining a premium indication for your physician or group is an easy process. We just ask for a handful of information. This will give you an idea of what your premium will run annually with Medical Protective. Here are the few items we need provided: • Copy of current declarations page, including group roster • Completed Indication Form This will give you an approximate indication of your annual premium with the MedPro Group.

Fowlkes McPherson Insurance | 803 Government Street Suite D | Mobile, AL 36602 | Phone: 251-433-9311

© Copyright Fowlkes McPherson Insurance. All Rights Reserved.

Website Design and Hosting by North Mobile Internet Services, Inc.

Fowlkes McPherson Insurance

Commercial Property and Casualty Insurance

Specializing in our Business so you can focus on yours!!!

251-433-9311

Medical Malpractice Insurance

Alabama Medical Malpractice Insurance: What you need to know. The medical malpractice insurance market in Alabama has some of the nation's lowest insurance premiums. The Alabama market has also significantly stabilized mostly due to the relatively calm legal climate in the state. The market was once dominated by ProAssurance ; however, new carriers have been attracted to Alabama in recent years. Some of the policy features one can expect on their Alabama medical malpractice insurance policy are: • Defense costs outside of the limits • Full consent to settle • Business entity coverage • Licensing action defense • Regulatory proceeding insurance • Cyber liability insurance Statute of Limitations In Alabama, medical malpractice claims must be brought within 2 years of the date of injury. If the injury was not discovered immediately, then a plaintiff has 6 months from the discovery date or the date that the injury should reasonably have been discovered. After 4 years from the date of the negligent act that gave rise to the injury, no action can be filed regardless of the date of discovery. If the case involves a minor, actions must be brought within 4 years of the negligent act. If the minor is less than 4 years of age, a case may be filed at any time before the child’s 8th birthdayUnderwriting

The fierce competition amongst medical malpractice carriers within the current "soft market" has pushed the underwriting process well beyond the realm of manual rates and formulaic quotations. We are seeing base rates slashed by up to 70% for applicable risks. How does a small to midsize practice access the maximum credits that can be realized in this environment? You need an agency skilled in the fluid terrain of this environment -- that can define and advocate each and every available credit while establishing competitive leverage most effectively in your favor. You need an agency who maintains positive relationships with their underwriters and has the ear of company executives whenever necessary. You need an agency who drafts clean submissions with clear narratives, who can convey where the leading edge of a winning target lies. You need an agency who can bring that target to the inked offer through relentless attentiveness throughout the entire submission process. There is much gamesmanship in the current market culture, and we love nothing more than winning big on your behalf.Renewals

Approximately 90 - 120 days prior to your program’s renewal, we will contact you for an annual review and evaluation. We will gather updated information as needed or requested by the incumbent market. We will discuss any recent changes that may have occurred in your practice, and collectively discuss our strategy in achieving the most optimum renewal results.Risk Management

For years MedPro Group has been the expert on risk management and patient safety issues. Our strong tradition of risk management continues today with comprehensive resources and solutions that are designed to help insureds improve patient safety and reduce liability exposures. MedPro Group insureds have access to a wealth of risk-related information and expertise, including core risk and specialty-specific publications, tools, and educational offerings, as well as a seasoned team of consultants who average more than 25 years in the industry. Additionally, MedPro Group is pleased to offer a variety of general and targeted risk management continuing education courses through our webinar program and preferred vendors. Insureds who successfully complete risk education might be eligible for a risk management premium credit at their next policy renewal. We believe that a strong risk management program is capable of reducing harm toward patients and protecting healthcare providers from liability. Through our services, we strive to increase awareness of enduring and emerging risks, improve patient safety, assist in prioritizing key issues for action, and work with insureds to demonstrate measurable improvement.Defense Attorney Panel

There is no stronger protection available in Alabama than our team of experts. In addition to providing you with winning defense, we arm you with: • Unparalleled national trial win history • 110-year track record of financial strength and stability • Commitment to Alabama physicians • True consent-to-settle provision with no strings attached • Access to more than 7,500 expert witnesses • Seasoned claims managers who average more than 20 years’ experience • A choice between occurrence and claims- made coveragePremium Indication Request

Obtaining a premium indication for your physician or group is an easy process. We just ask for a handful of information. This will give you an idea of what your premium will run annually with Medical Protective. Here are the few items we need provided: • Copy of current declarations page, including group roster • Completed Indication Form This will give you an approximate indication of your annual premium with the MedPro Group.